Packaging Automation Market Set for $2.4 Billion Growth by 2029

Strong Market Expansion Ahead

The global end-of-line and warehouse packaging automation market shows robust growth. According to Interact Analysis, the market will expand from $5.1 billion in 2024 to $7.5 billion by 2029. This represents a 7.9% compound annual growth rate. The Americas region and warehouse automation will drive significant growth.

Regional Investment Patterns

Companies in the Americas and Europe are increasing automation investments. They aim to counter rising labor costs and regulatory pressures. Meanwhile, APAC region growth stems mainly from manufacturing sector expansion. Labor costs play a lesser role in this region’s automation adoption.

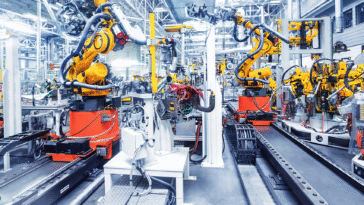

Manufacturing vs Warehouse Applications

End-of-line manufacturing automation currently dominates market revenue. It accounted for 61% of sector revenues in 2024. However, warehouse packaging automation shows faster growth potential. Case packers, sealers and erectors generated over $2.1 billion in 2024.

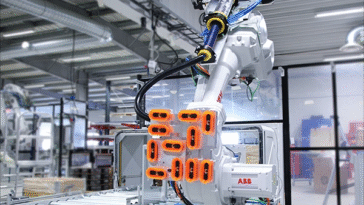

Key Growth Drivers

Warehouse automation growth comes from several key areas. Right-fit boxers, bagging machines and robotic palletizing show strong adoption. E-commerce demands and anti-waste legislation push retailers toward automation. Amazon’s European right-fit boxer deployment exemplifies this trend.

Market Maturity Analysis

Manufacturing packaging automation represents a more mature market. New deployments typically occur in new facilities or for throughput increases. Conversely, warehouse packaging retains significant manual processes. This creates substantial opportunities for automation vendors.

Industry Expert Perspective

Vanessa Lopez, Research Analyst at Interact Analysis, explains market dynamics. “Amazon has supercharged expectations for right-fit boxers,” she states. “Warehousing offers greater growth potential as many processes remain manual. Therefore, we anticipate stronger sales growth in warehouse applications.”

Strategic Implications

The packaging automation market presents distinct opportunities across sectors. Manufacturing applications maintain revenue dominance but show slower growth. Warehouse automation, though smaller currently, offers accelerated expansion potential. Machine vendors should align strategies with these market dynamics.

Frequently Asked Questions

What is the projected market growth?

The market will grow from $5.1 billion in 2024 to $7.5 billion by 2029, adding $2.4 billion in value.

Which regions drive growth?

The Americas lead growth, with Europe also showing strong investment. APAC growth stems from general manufacturing expansion.

What applications show strongest growth?

Warehouse packaging automation grows fastest, particularly right-fit boxers, bagging machines and robotic palletizing.

Why does warehouse automation grow faster?

Many warehouse packaging processes remain manual, creating significant automation opportunities compared to more mature manufacturing applications.

What factors drive automation adoption?

Labor costs, regulatory pressures, e-commerce demands and anti-waste legislation all contribute to automation investment.

About the Research

Interact Analysis provides comprehensive market intelligence for supply chain automation. Their latest report analyzes packaging machinery across end-of-line manufacturing and warehouse applications. With over 200 years of combined expertise, the firm delivers trusted insights for technology-driven growth.

No products in the cart.

No products in the cart.