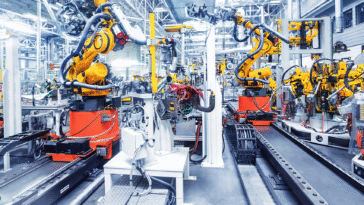

Mexico’s Manufacturing Transformation: How Automation Drives Growth

Manufacturing Employment Reaches Record Levels

Mexico’s manufacturing sector now employs approximately 9.7 million workers. This represents 16.3% of the country’s total workforce. The industry added 465,000 jobs in the past year alone. Manufacturing ranks as the third-largest employment sector after services and commerce. However, employment patterns show some variation across different regions and industries.

Advanced Manufacturing Creates High-Skill Opportunities

Automotive manufacturing leads employment in advanced sectors. Mexico ranks among the world’s top vehicle producers and exporters. Aerospace and electronics industries also show strong employment growth. Northern states like Nuevo León demonstrate particularly robust expansion. These regions benefit from established industrial infrastructure and supply chains.

Engineering Talent Pipeline Strengthens Manufacturing

Mexico graduates approximately 124,000 engineering professionals annually. Engineering represents the largest field of study at 26% of all graduates. The country ranks eighth globally for engineering graduate output. This strong educational foundation supports automation adoption across manufacturing sectors.

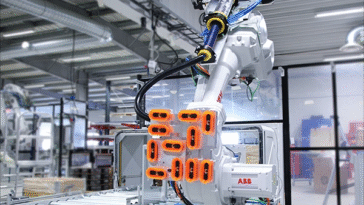

Government Initiatives Enhance Technical Training

Mexico has updated over 300 higher education programs for Industry 4.0 needs. The government created 129 new technical programs in robotics and automation. Specialized training in semiconductors and artificial intelligence expands workforce capabilities. These initiatives ensure manufacturers can access qualified technical staff.

Foreign Investment Concentrates in Advanced Manufacturing

Manufacturing captured 50% of Mexico’s record $36 billion FDI in 2023. Transportation equipment attracted 41% of manufacturing investment. Computer and electronics manufacturing received significant capital inflows. Northern industrial states attracted over half of all foreign investment.

Nearshoring Accelerates Automation Adoption

Nearshoring activity generates approximately 15% of new formal jobs. Companies establishing Mexican operations primarily serve U.S. markets. This trend reduces supply chain vulnerabilities while maintaining cost competitiveness. The integration enables smoother technology transfer and knowledge sharing.

Strategic Policies Support Industrial Advancement

Mexico’s National Industrial Policy targets high-value sectors like electric vehicles and semiconductors. The IMMEX program allows duty-free import of automation equipment for export manufacturing. State-level incentives include tax reductions for automation and IT companies. These policies encourage technology adoption and workforce development.

Implementation Considerations for North American Businesses

Companies should evaluate regional infrastructure and workforce availability. Understanding local incentive programs can optimize investment returns. Building relationships with educational institutions ensures talent pipeline access. Monitoring trade policy developments remains essential for strategic planning.

Future Outlook and Strategic Positioning

Mexico’s manufacturing sector shows strong momentum despite trade uncertainties. The skilled workforce continues expanding through educational initiatives. Advanced manufacturing capabilities are deepening across multiple industries. Strategic positioning in Mexico offers competitive advantages for North American supply chains.

Frequently Asked Questions

What manufacturing sectors show strongest growth in Mexico?

Automotive, aerospace, electronics, and electric vehicle manufacturing demonstrate particularly strong expansion and investment.

How does Mexico’s educational system support manufacturing?

Mexico graduates over 120,000 engineers annually and has updated hundreds of technical programs to meet Industry 4.0 requirements.

What regions offer the best manufacturing infrastructure?

Northern states like Nuevo León, Sonora, and Chihuahua have established industrial clusters with advanced infrastructure and supply chains.

How significant is nearshoring to Mexico’s manufacturing growth?

Nearshoring generates approximately 15% of new formal jobs and drives substantial foreign investment in advanced manufacturing sectors.

What government incentives support automation investment?

IMMEX programs, tax incentives, workforce development initiatives, and state-level benefits create favorable conditions for automation adoption.

No products in the cart.

No products in the cart.